Goldman Sachs warns: Shipping industry recession could be longer and more severe!

Regarding the future of the shipping industry, Goldman Sachs warned that the recession will be deeper and longer than the market expects.

Previously, according to media reports, the four major shipping giants, Maersk, CMA CGM, ONE and Evergreen Line, have all made predictions on the shipping market conditions. Among them, Evergreen Shipping even bluntly stated that 2024 will be full of challenges.

Goldman Sachs warns shipping industry recession will continue

Goldman Sachs analyst Patrick Creuset predicted in his latest report that the shipping industry's recession will be deeper and longer-lasting than the market thinks.

This will cause freight prices in the shipping industry and the company's profits to continue to decline. Maersk's future is not optimistic, and Maersk's rating is downgraded to "sell": "We believe that the market still has not recognized the severity and duration of the upcoming recession that shipping will face. time.

There is still excess freight capacity in the market, which will put pressure on the price of goods and the company's profits. Maersk's earnings are expected to fall by 8% in 2023-2024.

Creuset also said that although the shipping market is experiencing price declines, the supply in the shipping market is still relatively abundant due to the continuous launch of new ships, cargo can be delivered on time, and fewer ships being decommissioned and scrapped.

New vessels are being delivered at a pace of around 1% of the global fleet, with almost no delays, idleness and scrappage are low, and active vessel capacity is set to increase significantly on major routes in November.

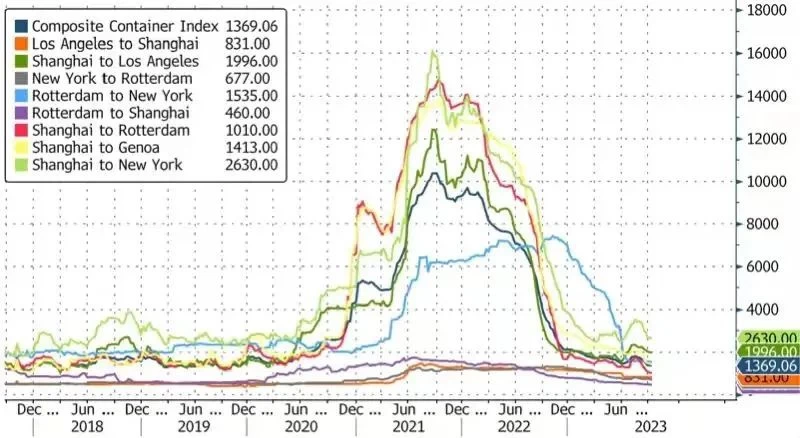

It is worth mentioning that the container shipping industry relies on global demand trends. During the new crown epidemic, it ushered in an unprecedented boom as retailers and other companies replenished inventory to meet pent-up demand from consumers, and it was difficult to find a container. , Freight prices continue to rise.

However, since peaking in early 2022, weak demand has caused container freight rates to fall sharply.

Creuset believes that compared with previous shipping markets, there are two main factors that may cause Maersk's profit margins to decline more severely this time.

One is that the industry's balance sheet has been highly leveraged in the past. That means cash flow can't last very long, and this time around, most carriers are sitting on billions of dollars in cash.

The second is the evolution of alliance structures in the shipping industry. These changes may lead some shipping lines to become more autonomous, but may also make it more difficult to manage excess cargo capacity.

Operators are still ordering new ships, a sign that the industry needs more tools to manage capacity.

Maersk previously issued a warning, saying that the duration and extent of global trade contraction were greater than expected, demand in Europe and the United States was declining, and there were "dark clouds" ahead.

Its CEO Vincent Clerc previously stated that the container shipping industry is in the biggest adjustment period after the COVID-19 boom in 2021 and 2022, and the duration and extent of global trade contraction may be longer than previously thought.

Shipping companies predict shipping industry will be more difficult next year

It is reported that when Maersk announced its first-half financial report, it also announced its forecast for the future market, which mainly includes three major points: the global container transaction volume is reduced, and is expected to shrink by up to 4%; the destocking adjustment is expected to be postponed until the end of the year.

The first quarter profit may be the best quarter of the year. Challenges in the second half of the year still include inflation, interest rate hikes, recession risks, and some uncertainties. Maersk's raising of the low target for full-year EBITDA is expected to alleviate the recession by cutting costs. impact.

At the same time, CMA CGM also released its views on the market outlook: In the second half of the year, global growth will continue to slow down and the transportation and logistics market will be sluggish due to inflation, interest rate increases, and geopolitical uncertainty.

In the next few quarters, new shipping capacity will continue to put pressure on spot freight increases, especially freight rates on east-west routes; trans-Pacific and Asia-Europe routes will be affected by the slowdown in household consumption and the destocking of retailers.

Japanese shipping company ONE said that changes in consumer behavior and the intensification of international tensions have further led to changes in transaction patterns; transportation demand and transaction patterns continue to change, and the market prospects are difficult to predict.

Recently, according to Reuters, Rolf Habben Jansen, CEO of German shipping company Hapag-Lloyd, said that the container shipping industry is expected to struggle in the next three years as demand for shipping services grows slower than existing capacity.

Nonetheless, Jansen does not believe the downturn in the shipping industry will be as severe as that seen after the global financial crisis in 2008, when new capacity accounted for 55% of the existing fleet. Now, that number is only 27%.

He added that freight rates have dropped by about 60% year-on-year. "The container shipping industry has always been a cyclical industry, however, I don't think it will be as bad as 2008 and 2009."