Made a record! More than 40 container ships waiting for berths outside Los Angeles and Long Beach

On the 26th local time, the number of ships berthing at the two largest container ports in the United States waiting to open berths set a new record. More than 40 ships are now lined up at anchorages that are further and further away from Los Angeles and Long Beach terminals.

The abnormal congestion of the two main west coast ports in the United States is much more serious than the port suspension in 2002 and 2004. When the Port of Los Angeles and Long Beach were blocked for 10 days and 8 days respectively in 2002 and 2004, the line of ships never exceeded 30, but the port blockade caused serious economic chaos. The situation today is much more serious.

41 container ships are waiting for berths at or near the San Pedro anchorage, which has never been such a busy peak season in the 65-year history of the container shipping industry. According to data from the Port of Los Angeles in August, 90% of ships sail directly to the anchorage to join the anchoring queue, with an average anchoring time of 7.8 days.

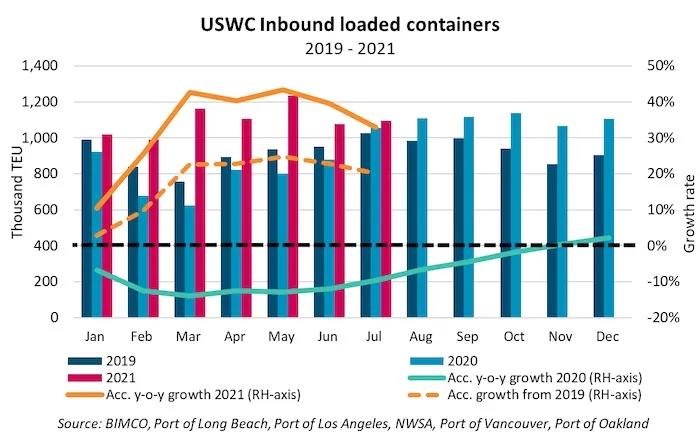

Peter Sand, chief shipping economist at BIMCO, a global shipowner organization, said: “Some of these shippers are already in low inventory. They are stocking up in advance to ensure inventory for the upcoming key sales seasons (such as Black Friday and Christmas). "

Peter Sand said that the dock workers at the two ports were unable to load and unload containers in and out of the port in a timely and fast manner. "Because the yard density is now quite high, logistics efficiency has dropped." Sand explained. The lack of chassis in various parts of the United States also makes ships wait longer.

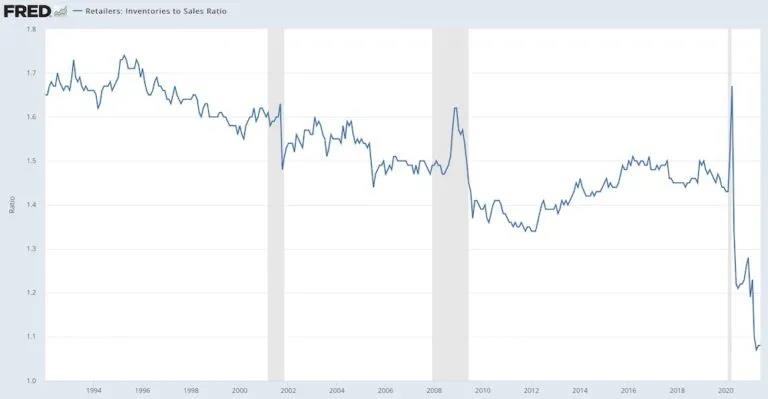

U.S. retailers are struggling with record low inventories, which may mean that the container tightening situation will worsen in the coming weeks. The current inventory-to-sales ratio is only 1.08, which can only maintain one month's sales.

Commenting on the lack of inventory, Steve Ferreira, CEO of Ocean Audit in New York, said: "This is why importers/retailers are paying high fees for boat rentals and $15,000/FEU space. The small green dots on the AIS show dozens of The reason why an ocean-going vessel is trying to berth."

Earlier this month, Gene Seroka, executive director of the Port of Los Angeles, introduced the latest status of operations. He said that the challenge facing the entire supply chain is equivalent to "squeezing 10 highway lanes into 5 lanes."

▼The map below shows the ships moored in San Pedro Bay

▼All container ships going to Los Angeles and Long Beach Port in the next 28 days

Port managers advise consumers to make Christmas shopping plans as early as this year, otherwise some families may disappoint on December 25.

This month, as the main anchorages and overflow anchorages in the bay were full, the Southern California Ocean Exchange was forced to open the drifting area.

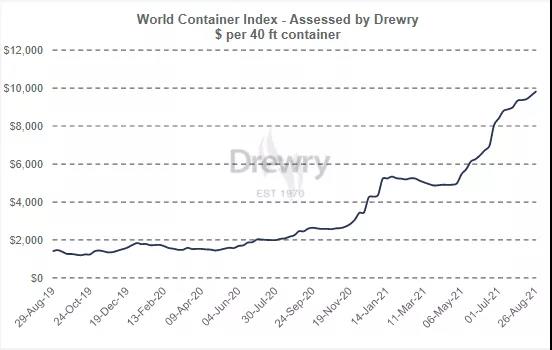

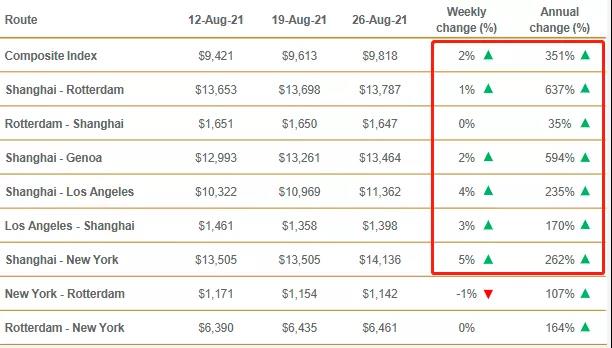

According to the weekly World Container Index released by Drewry on the 26th, the World Container Index rose by 2.1%, or US$204, to US$9,817.72 per 40-foot container, 351% higher than the same week in 2020. This is the 19th consecutive week of gains.

The freight rate in the trans-Pacific region has increased even more. The freight rate of the eastbound trans-Pacific route from Shanghai to Los Angeles soared by 4%, from US$393 to US$11,362/FEU, while the freight rate per 40-foot container from Shanghai to New York soared by 5%, or 631. USD to 14,136 USD/FEU.

According to Drewry’s latest report on the 27th, out of 504 voyages on major routes across the Pacific, transatlantic, Asia to Northern Europe and the Mediterranean, 17 voyages were announced to be cancelled between the 35th and 38th weeks, with a cancellation rate of 3%; In the next 4 weeks, THE Alliance announced the cancellation of 9 voyages, followed by the cancellation of 7 voyages by the Ocean Alliance.

Due to continued port congestion around the world; equipment backlogs, delays and shortages have further increased, and ocean-going spot rates continue to remain at extreme levels. While cargo owners and freight forwarders are struggling to cope with delays and business interruptions, many small cargo owners find that continuously high spot rates are unsustainable.