“It’s impossible to grab a container!” A new wave of price increases will come in June!

As time goes by, the impact of deviations caused by the situation in the Red Sea continues to emerge. Recently, container freight rates have risen again, and freight forwarding companies generally report that the "lack of containers" problem is serious...

June will usher in a new wave of price increases

Some analysts pointed out that there is little idle capacity in the current market, and the current capacity is somewhat insufficient in the context of red sea diversions, and the diversion effect is apparent.

Judging from the current performance of spot freight rates, the European-European Line takes the Shanghai-Rotterdam route as an example. GeekYum data shows that on May 10, liner companies quoted prices in the range of US$4,040/FEU-US$5,554/FEU. On April 1, , the route is quoted at US$2,932/FEU-US$3,885/FEU.

The U.S. line has also increased significantly compared to before. The quotation from Shanghai to Los Angeles and Long Beach Port on May 10 reached a maximum of 6,457 US dollars/FEU.

As demand in Europe and the United States picks up, as well as concerns about the increasing detour time of the Red Sea crisis and delays in shipping schedules, cargo owners have also increased their efforts to replenish inventory, and the overall freight rate will increase again.

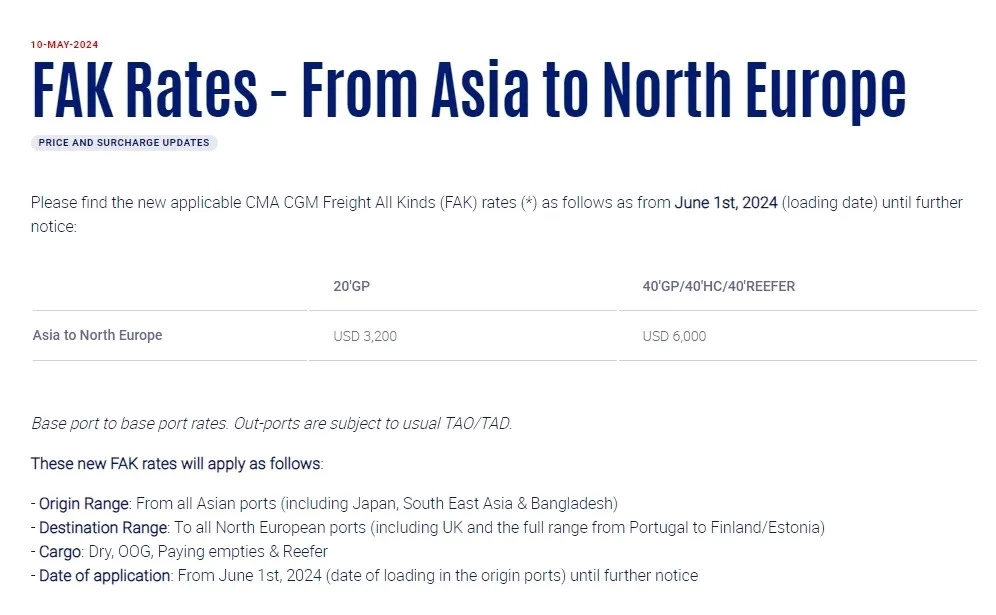

It is worth noting that the two major shipping giants Maersk and CMA CGM have announced plans to increase prices in June, that is, they will increase the Nordic FAK rate from June 1. Among them, Maersk’s price per 40-foot container is up to US$5,900, while CMA CGM raised the price by another US$1,000 based on the 15th, to US$6,000 per 40-foot container.

In addition, Maersk will impose a South American East Peak Season surcharge of US$2,000 per 40-foot container starting from June 1.

Affected by the geopolitical conflict in the Red Sea, global ships are forced to detour around the Cape of Good Hope, which not only significantly increases transportation time, but also leads to major challenges in ship dispatching.

The ships sailing to Europe every week are of different sizes, which brings great trouble to customers when booking space. European and American traders have also begun to replenish inventory in advance to avoid facing shortage of shipping space during the peak season of July and August.

The person in charge of a freight forwarding company said, "The freight prices have started to rise again, and it is impossible to get boxes!" This "lack of boxes" is essentially a lack of shipping space.

Seats are fully booked until the end of May

According to ocean liner company COSCO Shipping Holdings (601919.SH), the company's current production and operations are normal, and exports to Europe and the United States are fully loaded.

At the same time, the latest market report released by Kuehne Nagel, the world's largest ocean freight forwarding company, shows that the overall space situation on the China-Europe route is relatively tight in May, and freight rates are expected to continue to rise in the next two weeks.

In terms of China-U.S. routes, the loading rate of the U.S. line continued to be fully loaded in the first half of the month, especially in the West America. The situation of limited low-price cabins and tight FAK cabins will continue until the second half of the year. Canadian railway workers will go on strike on May 22. potential risks.

On May 10, the latest Shanghai Containerized Export Freight Index (SCFI) rose sharply by 365.16 points to 2305.79 points, an increase of 18.82%. It not only achieved five consecutive weeks of increases, but also saw increases in major routes such as Europe, North America, South America, Australia and New Zealand. Both are around 20%. Among them, the European line has the largest increase of nearly 25%.

Data released by the Ningbo Shipping Exchange on the 10th showed that the NCFI comprehensive index this week was 1812.8 points, an increase of 13.3% from last week. Among them, the European route freight index was 1992.9 points, an increase of 22.9% from last week; the freight rate of the West-West route was 1992.9 points, an increase of 22.9% from last week; The index was 2435.9 points, an increase of 23.5% from last week.

For the North American route, the freight index for the West-American route was 2628.8 points, an increase of 5.8% from last week. The East African route fluctuated greatly, with the freight index at 1552.4 points, an increase of 47.5% from last week.

According to insiders in the freight forwarding industry, as shipping companies continue to control cabins and reduce and combine shifts during the May Day holiday, the cabins are full before the end of May, and many urgent cargoes may not be able to get on board despite the increased prices. It can be said that it is difficult to find a cabin at present. .

Industry insiders said they never expected that market demand would be so huge after the May Day holiday. Previously, in response to the May Day holiday, shipping companies generally increased the proportion of blank flights by about 15-20%.

This has led to a tight space situation on North American routes in early May, and the space is currently full before the end of the month. Therefore, many planned shipments can only wait for the June ship.

Sunny Worldwide Logistics has been established for more than 25 years. It has purchased 1,800 square meters of Grade A office buildings in Shenzhen. It has its own warehousing and self-operated fleet in Shenzhen, which greatly meets the supporting needs of customers. Ocean freight has signed contracts with shipowners such as ZIM/EMC/OOCL/CMA, and air freight has signed contracts with airlines such as O3/MH/CZ. Within the company, there are about 65 senior employees. The company has established the "Sunny Business School" to continuously improve the comprehensive quality of employees. With this goal in mind, regular and uninterrupted training and sharing has created a group of logistics personnel with excellent comprehensive qualities.