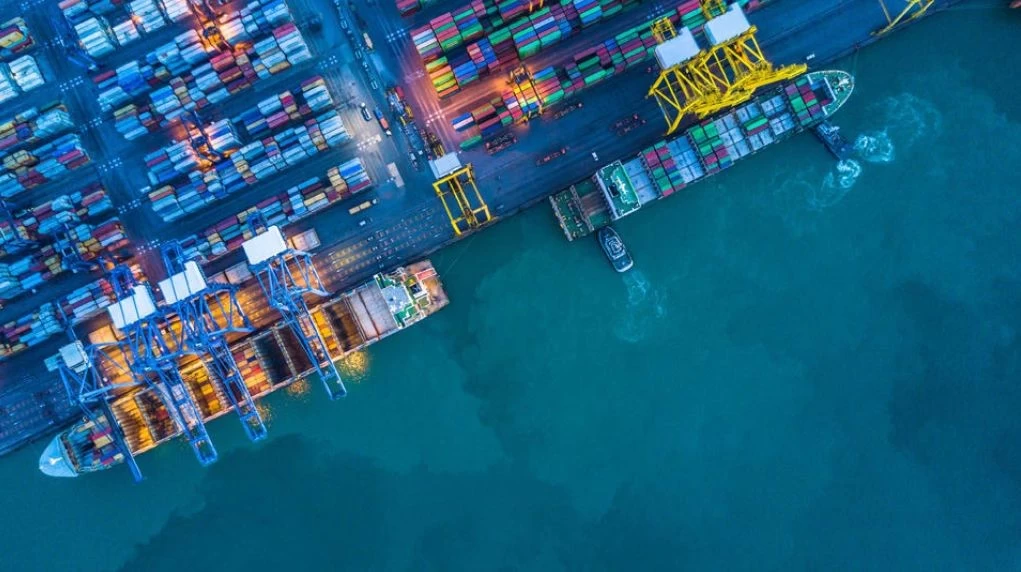

The shipping price is $10,000! Quadruple in one week! There were 313 circumnavigating ships, 4.2 million TEUs, and the cargo value exceeded 100 billion US dollars.

Recently, affected by the Red Sea crisis, merchant ships from more than 10 major shipping companies in the world have avoided the Red Sea-Suez Canal and detoured to the Cape of Good Hope in Africa. This has triggered concerns among companies about the safe delivery of goods. In order to ensure that goods can be delivered safely and on time, some companies have begun to use bypass, air transport, and combined sea and air transportation methods.

This change has brought new challenges to global logistics, which requires dealing with the risk of rising sea and air freight prices. Quotations have been obtained for January, with the freight rate from China to the UK reaching US$10,000 per 40 feet. It’s surprising that a supply chain crisis would return in this way three years after the pandemic began.

According to the booking quotation obtained by Loadstar media, the sea freight for a standard-size 40-foot container from Shanghai to the UK is US$10,000. A week ago, the freight price was only US$2,400. At the same time, truck freight prices in the Middle East have at least doubled.

Peter Sand, chief analyst at freight benchmarking company Xeneta, pointed out that although the current market freight rate has not yet reached the average level, shippers may need to pay higher fees for some urgently needed goods.

Sand further said: "The arrival of the Lunar New Year, combined with the rising demand in the upcoming season, makes the situation faced by all participants more tense." "A huge freight peak is coming."

It is also an indisputable fact that freight rates on European routes and Red Sea routes have increased several times. Alan Baer, CEO of logistics giant OL USA, pointed out that because ships need to turn in real time to avoid the risk of attacks by Houthi armed forces in Yemen, ocean carriers have made rapid adjustments A quote was requested to cover the increased cost. Compared with the changes during the epidemic, this time the adjustment is faster, and on some trade routes, freight rates have even increased by 100% to 300%.

According to data released by Kuehne + Nagel, as of Friday (December 22), 313 ships have been identified as being affected by the situation in the Red Sea. Total capacity is expected to be 4.2 million TEU. Maritime transport data company MDS Transmodal estimates the value of rerouted cargo at around $105 billion.

Although the pressure on transportation costs is inevitably passed on to consumers in the supply chain, whether air freight or detours are used, the cost will further increase. Alan Bell mentioned that the freight rate for a standard container from India to the East Coast of the United States soared from about US$2,000 to US$7,000 in just 30 days.

Sunny Worldwide Logistics We offer China-Europe freight trains and air freight as an alternative to sea freight. It usually takes more than 20 days to reach Europe by sea, and it takes about 10 more days after detouring around the Cape of Good Hope. It usually takes about 16 days to arrive via the China-Europe freight train, and the cargo transportation time can be shortened by 20 days compared with sea transportation.