The highest increase exceeds 10,000 US dollars! Another shipping company announced a price increase, and the liner company’s revenue next year will "take a higher level"

Some time ago, CMA announced the suspension of spot rate increases, and Hapag-Lloyd also announced a "freeze increase" shortly thereafter. For a time, the industry began to think that ocean freight rates would start a downward path.

But is this really the case?

Up to $10,761! MSC issued three price increase projects in a row

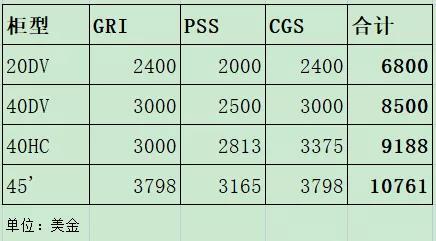

It is reported that the world's second largest container liner company, Mediterranean Shipping Company, recently issued two price increase notices and launched three major price increase items in one go: freight increase (GRI), peak season surcharge (PSS) and port congestion charge (CGS)!

Just from the three fees (GRI, PSS and the new round of CGS) that will be pushed up on October 15th, the 40-foot container has risen as much as 9188 US dollars, and the 45-foot container has increased by astonishing US$10,761!

One of the price increase notices of Mediterranean Shipping shows that starting from October 15 (Gate in Date), the freight (GRI) and peak season surcharge (PSS) will be increased at the same time!

The scope of this freight rate increase is also very special. It is aimed at cargoes whose ports of departure are South China Ports and Hong Kong, and their destination ports are East and West US ports.

In another price increase notice issued by Mediterranean Shipping on September 16, except for a port congestion charge postponed from July 30 to August 19, from October 15 (Gate in Date), this The shipping company will raise the port congestion charge (CGS) again!

I originally thought that after CMA CGM and Hapag-Lloyd, other shipping companies would start to stop raising prices, and the market freight level would have a chance to maintain the status quo. I didn't expect Mediterranean Shipping to be so "big-handed" this time!

The revenue of shipping companies in 2022 will exceed this year!

Earlier, Maersk CEO Soren Skou called the fourth quarter performance of 2020 the best performance ever. On February 10 this year, he announced Maersk’s 2021 preliminary results for the full year, stating that the best scenario is 2021. The annual performance is four times that of the fourth quarter of 2020.

However, this expectation has already been updated. A few days ago, Maersk raised its full-year performance forecast for the third time.

It now appears that the profit of the shipping company in the second half of the year is even greater than that of the first half, which is even more unfavorable for the freight company.

But it may not peak in the second half of the year. A recent Deutsche Bank forecast says that shipping companies'actual revenues in 2022 will exceed this year's.

Stifel analyst Ben Nolan said: "We expect the enthusiasm of the container shipping market to weaken until later next year, or even 2023."

Another signal of strong performance in the second half of the year comes from Evergreen Shipping, which publicly reports monthly operating income.

In the past two months, Evergreen’s operating income has hit a record high: July revenue was NT$45.88 billion, or about US$1.65 billion, and August revenue was NT$50.02 billion, or about US$1.8 billion.

Evergreen's revenue in the first two months of the third quarter was almost the same as that of the entire second quarter.

Monthly revenue of Evergreen Shipping, January 20-21 August:

Deutsche Bank forecast: The container shipping market enters a "super cycle"

On Monday, the UK-based Deutsche Bank released a report that is extremely optimistic about the container shipping market.

"We are turning to the view that the revenue of shipping companies will peak in 2022, not this year." Andy Chu wrote, "There is a big surprise for shipping companies' forecasts for 2022 and 2023, but they have not Include consensus forecasts."

In May of this year, Andy Chu predicted: "The trend of supply chain disruption and port congestion will begin to improve, which will cause spot freight rates to fall."

"However, since then, we have clearly seen that not only has the demand in the container shipping market become stronger, but also supply chain problems and port congestion are worsening rather than improving." Andy Chu said, "Considering the severe port congestion and the persistence of the Covid-19 pandemic, we believe that these problems will not be resolved soon."

Deutsche Bank raised Maersk’s 2021 EBITDA forecast to US$22.18 billion (before Maersk’s latest increase) and believes that the shipping company will earn more next year: US$23.77 billion.

Deutsche Bank has also seen the same profit growth pattern of Hapag-Lloyd. The shipping company's internal forecast (as of the end of July) 2021 EBITDA will reach 9.2 billion-11.2 billion US dollars. Deutsche Bank predicts that Hapag-Lloyd’s revenue this year will reach 11.54 billion U.S. dollars and next year it will reach 11.88 billion U.S. dollars.